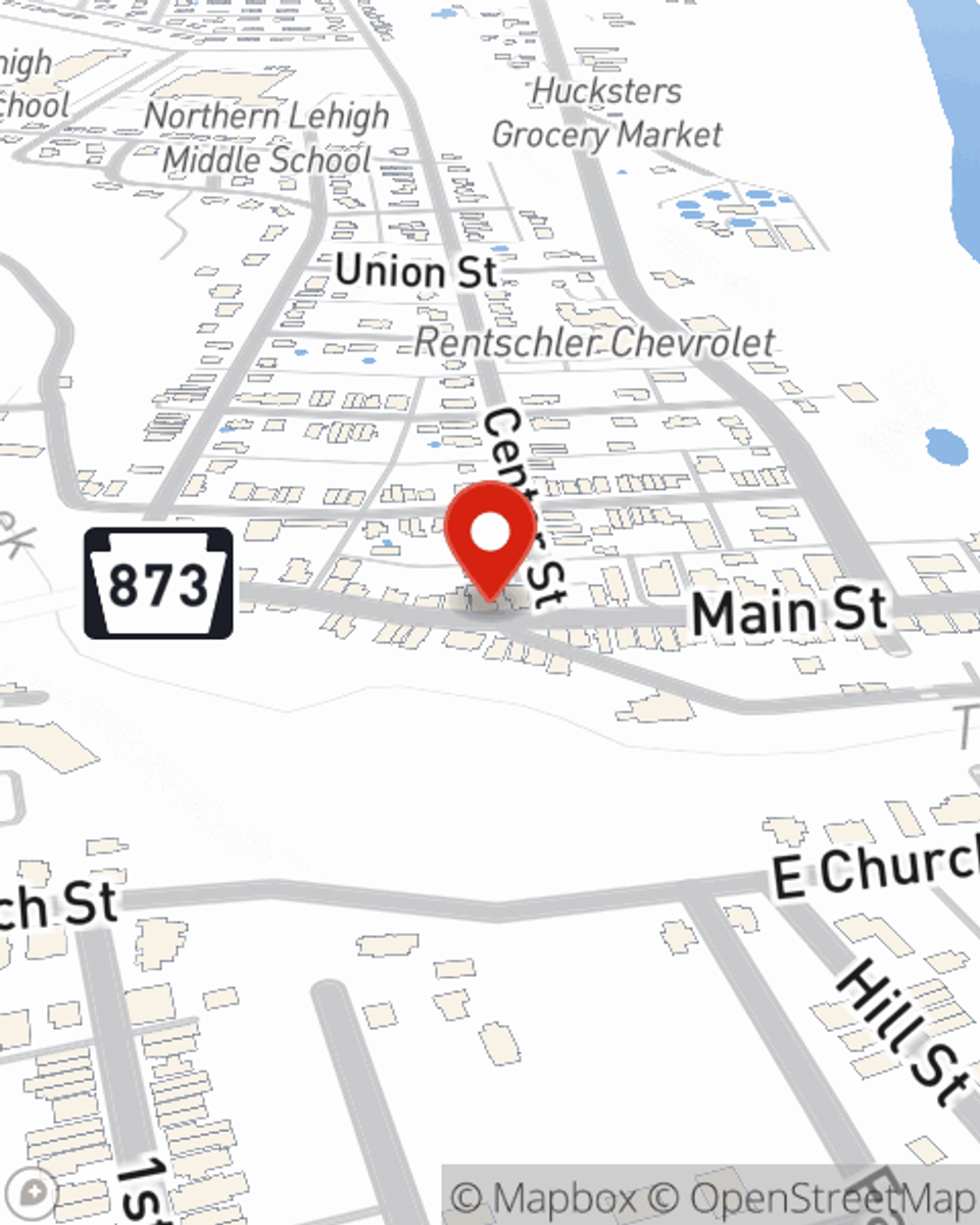

Life Insurance in and around Slatington

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

- Slatington

- Walnutport

- Jim Thorpe

- Schnecksville

- Allentown

- Bethlehem

- New Tripoli

- Albrightsville

- Blakeslee

- Northampton

- Fogelsville

- Alburtis

- Macungie

- Emmaus

- Coplay

- Whitehall

- Easton

- Palmerton

- Lehighton

- Lehigh County

- Northampton County

- Carbon County

- Monroe County

- Bucks County

Your Life Insurance Search Is Over

There's a common misconception that Life insurance isn't necessary when you're still young, but even if you are young and just rented your first place, now could be the right time to start learning about Life insurance.

Get insured for what matters to you

What are you waiting for?

Put Those Worries To Rest

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With a protection plan from State Farm, you can lock in outstanding costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Geoff Mosebach or one of their knowledgeable representatives. Geoff Mosebach can help design coverage options for the level of coverage you have in mind.

Wherever you're at in life, you're still a person who could need life insurance. Reach out to State Farm agent Geoff Mosebach's office to discover the options that are right for you and the ones you love most.

Have More Questions About Life Insurance?

Call Geoff at (610) 694-0650 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Geoff Mosebach

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.